Chapter 30 Multiple Linear Regression

30.1 Objectives

- Create and interpret a model with multiple predictors and check assumptions.

- Generate and interpret confidence intervals for estimates.

- Explain adjusted \(R^2\) and multi-collinearity.

- Interpret regression coefficients for a linear model with multiple predictors.

- Build and interpret models with higher order terms.

30.2 Introduction to multiple regression

The principles of simple linear regression lay the foundation for more sophisticated regression methods used in a wide range of challenging settings. In our last two lessons, we will explore multiple regression, which introduces the possibility of more than one predictor.

30.3 Multiple regression

Multiple regression extends simple two-variable regression to the case that still has one response but many predictors (denoted \(x_1\), \(x_2\), \(x_3\), …). The method is motivated by scenarios where many variables may be simultaneously connected to an output.

To explore and explain these ideas, we will consider Ebay auctions of a video game called Mario Kart for the Nintendo Wii. The outcome variable of interest is the total price of an auction, which is the highest bid plus the shipping cost. We will try to determine how total price is related to each characteristic in an auction while simultaneously controlling for other variables. For instance, with all other characteristics held constant, are longer auctions associated with higher or lower prices? And, on average, how much more do buyers tend to pay for additional Wii wheels (plastic steering wheels that attach to the Wii controller) in auctions? Multiple regression will help us answer these and other questions.

The data set is in the file mariokart.csv in the data folder. This data set includes results from 141 auctions.95 Ten observations from this data set are shown in the R code below. Just as in the case of simple linear regression, multiple regression also allows for categorical variables with many levels. Although we do have this type of variable in this data set, we will leave the discussion of these types of variables in multiple regression for Math 378.

mariokart <-read_csv("data/mariokart.csv")

head(mariokart,n=10)## # A tibble: 10 x 12

## id duration n_bids cond start_pr ship_pr total_pr ship_sp seller_rate

## <dbl> <dbl> <dbl> <chr> <dbl> <dbl> <dbl> <chr> <dbl>

## 1 1.50e11 3 20 new 0.99 4 51.6 standa~ 1580

## 2 2.60e11 7 13 used 0.99 3.99 37.0 firstC~ 365

## 3 3.20e11 3 16 new 0.99 3.5 45.5 firstC~ 998

## 4 2.80e11 3 18 new 0.99 0 44 standa~ 7

## 5 1.70e11 1 20 new 0.01 0 71 media 820

## 6 3.60e11 3 19 new 0.99 4 45 standa~ 270144

## 7 1.20e11 1 13 used 0.01 0 37.0 standa~ 7284

## 8 3.00e11 1 15 new 1 2.99 54.0 upsGro~ 4858

## 9 2.00e11 3 29 used 0.99 4 47 priori~ 27

## 10 3.30e11 7 8 used 20.0 4 50 firstC~ 201

## # ... with 3 more variables: stock_photo <chr>, wheels <dbl>, title <chr>We are only interested in total_pr, cond, stock_photo, duration, and wheels. These variables are described in the following list:

total_pr: final auction price plus shipping costs, in US dollars

cond: a two-level categorical factor variable

stock_photo: a two-level categorical factor variable

duration: the length of the auction, in days, taking values from 1 to 10

wheels: the number of Wii wheels included with the auction (a Wii wheel is a plastic racing wheel that holds the Wii controller and is an optional but helpful accessory for playing Mario Kart)

30.3.1 A single-variable model for the Mario Kart data

Let’s fit a linear regression model with the game’s condition as a predictor of auction price. Before we start let’s change cond and stock_photo into factors.

mariokart <- mariokart %>%

mutate(cond=factor(cond),stock_photo=factor(stock_photo))Next let’s summarize the data.

inspect(mariokart)##

## categorical variables:

## name class levels n missing

## 1 cond factor 2 143 0

## 2 ship_sp character 8 143 0

## 3 stock_photo factor 2 143 0

## 4 title character 80 142 1

## distribution

## 1 used (58.7%), new (41.3%)

## 2 standard (23.1%), upsGround (21.7%) ...

## 3 yes (73.4%), no (26.6%)

## 4 (%) ...

##

## quantitative variables:

## name class min Q1 median Q3

## ...1 id numeric 1.104392e+11 1.403506e+11 2.204911e+11 2.953551e+11

## ...2 duration numeric 1.000000e+00 1.000000e+00 3.000000e+00 7.000000e+00

## ...3 n_bids numeric 1.000000e+00 1.000000e+01 1.400000e+01 1.700000e+01

## ...4 start_pr numeric 1.000000e-02 9.900000e-01 1.000000e+00 1.000000e+01

## ...5 ship_pr numeric 0.000000e+00 0.000000e+00 3.000000e+00 4.000000e+00

## ...6 total_pr numeric 2.898000e+01 4.117500e+01 4.650000e+01 5.399000e+01

## ...7 seller_rate numeric 0.000000e+00 1.090000e+02 8.200000e+02 4.858000e+03

## ...8 wheels numeric 0.000000e+00 0.000000e+00 1.000000e+00 2.000000e+00

## max mean sd n missing

## ...1 4.000775e+11 2.235290e+11 8.809543e+10 143 0

## ...2 1.000000e+01 3.769231e+00 2.585693e+00 143 0

## ...3 2.900000e+01 1.353846e+01 5.878786e+00 143 0

## ...4 6.995000e+01 8.777203e+00 1.506745e+01 143 0

## ...5 2.551000e+01 3.143706e+00 3.213179e+00 143 0

## ...6 3.265100e+02 4.988049e+01 2.568856e+01 143 0

## ...7 2.701440e+05 1.589842e+04 5.184032e+04 143 0

## ...8 4.000000e+00 1.146853e+00 8.471829e-01 143 0Finally, let’s plot the data.

mariokart %>%

gf_boxplot(total_pr~cond) %>%

gf_theme(theme_bw()) %>%

gf_labs(title="Ebay Auction Prices",x="Condition", y="Total Price")

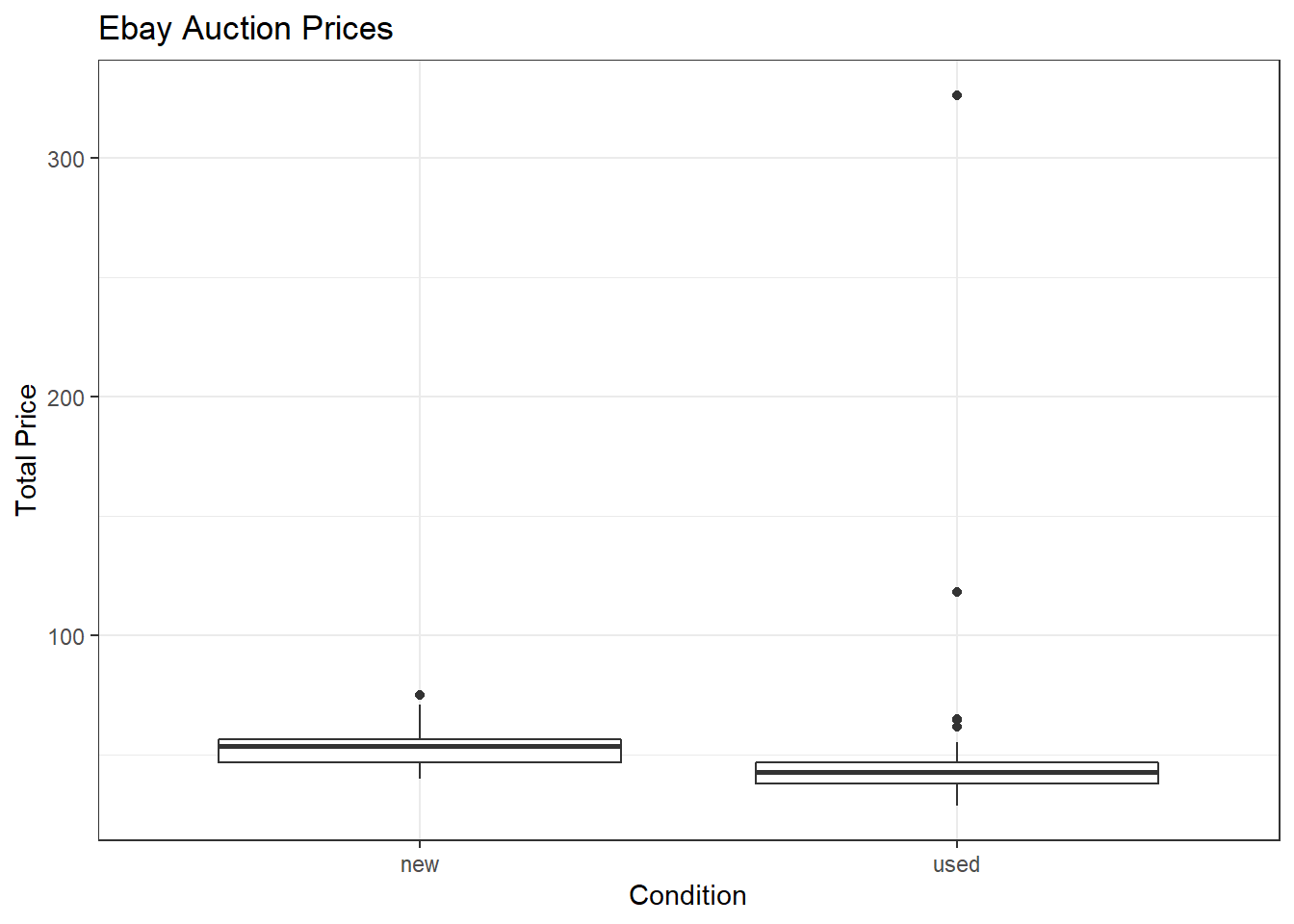

Figure 30.1: Total price of Mario Kart on Ebay for each condition.

We have several outliers that may impact our analysis, Figure 30.1.

Now let’s build the model.

mario_mod <- lm(total_pr~cond,data=mariokart)summary(mario_mod)##

## Call:

## lm(formula = total_pr ~ cond, data = mariokart)

##

## Residuals:

## Min 1Q Median 3Q Max

## -18.168 -7.771 -3.148 1.857 279.362

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 53.771 3.329 16.153 <2e-16 ***

## condused -6.623 4.343 -1.525 0.13

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 25.57 on 141 degrees of freedom

## Multiple R-squared: 0.01622, Adjusted R-squared: 0.009244

## F-statistic: 2.325 on 1 and 141 DF, p-value: 0.1296The model may be written as

\[ \hat{\text{totalprice}} = 53.771 - 6.623 \times \text{condused} \]

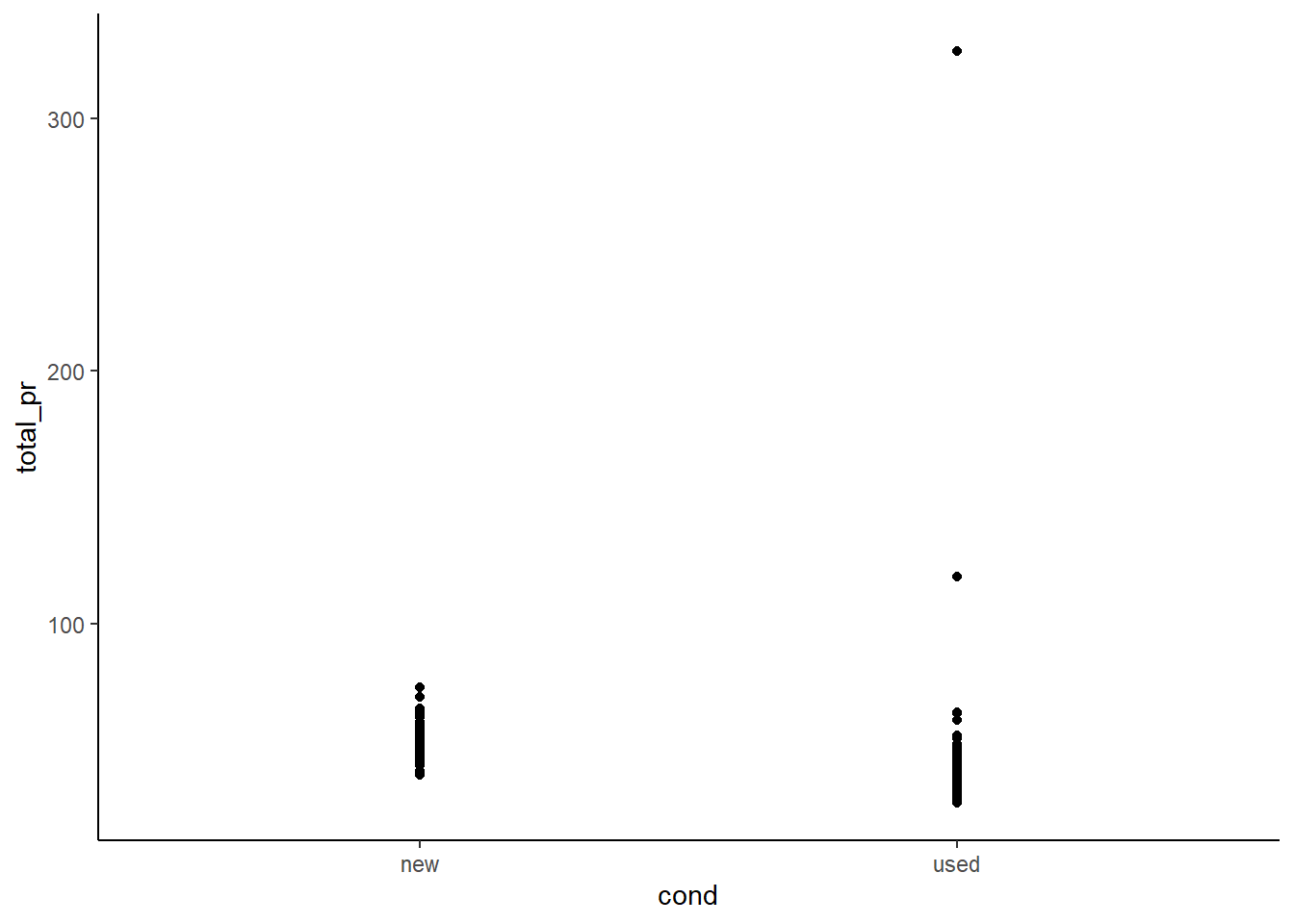

A scatterplot for price versus game condition is shown in Figure 30.2.

mariokart %>%

gf_point(total_pr~cond) %>%

gf_theme(theme_classic())

Figure 30.2: Scatterplot of total price of Mario Kart on Ebay versus condition.

That outlier probably is significantly impacting the relationship in the model. If we find the mean and median for the two groups, we will see this.

mariokart %>%

group_by(cond) %>%

summarize(xbar=mean(total_pr), stand_dev=sd(total_pr),xmedian=median(total_pr))## # A tibble: 2 x 4

## cond xbar stand_dev xmedian

## <fct> <dbl> <dbl> <dbl>

## 1 new 53.8 7.44 54.0

## 2 used 47.1 32.7 42.8It appears that used items have a higher average price solely because of at least one of the outliers.

There are at least two outliers in the plot. Let’s gather more information about them.

mariokart %>%

filter(total_pr > 100)## # A tibble: 2 x 12

## id duration n_bids cond start_pr ship_pr total_pr ship_sp seller_rate

## <dbl> <dbl> <dbl> <fct> <dbl> <dbl> <dbl> <chr> <dbl>

## 1 1.10e11 7 22 used 1 25.5 327. parcel 115

## 2 1.30e11 3 27 used 6.95 4 118. parcel 41

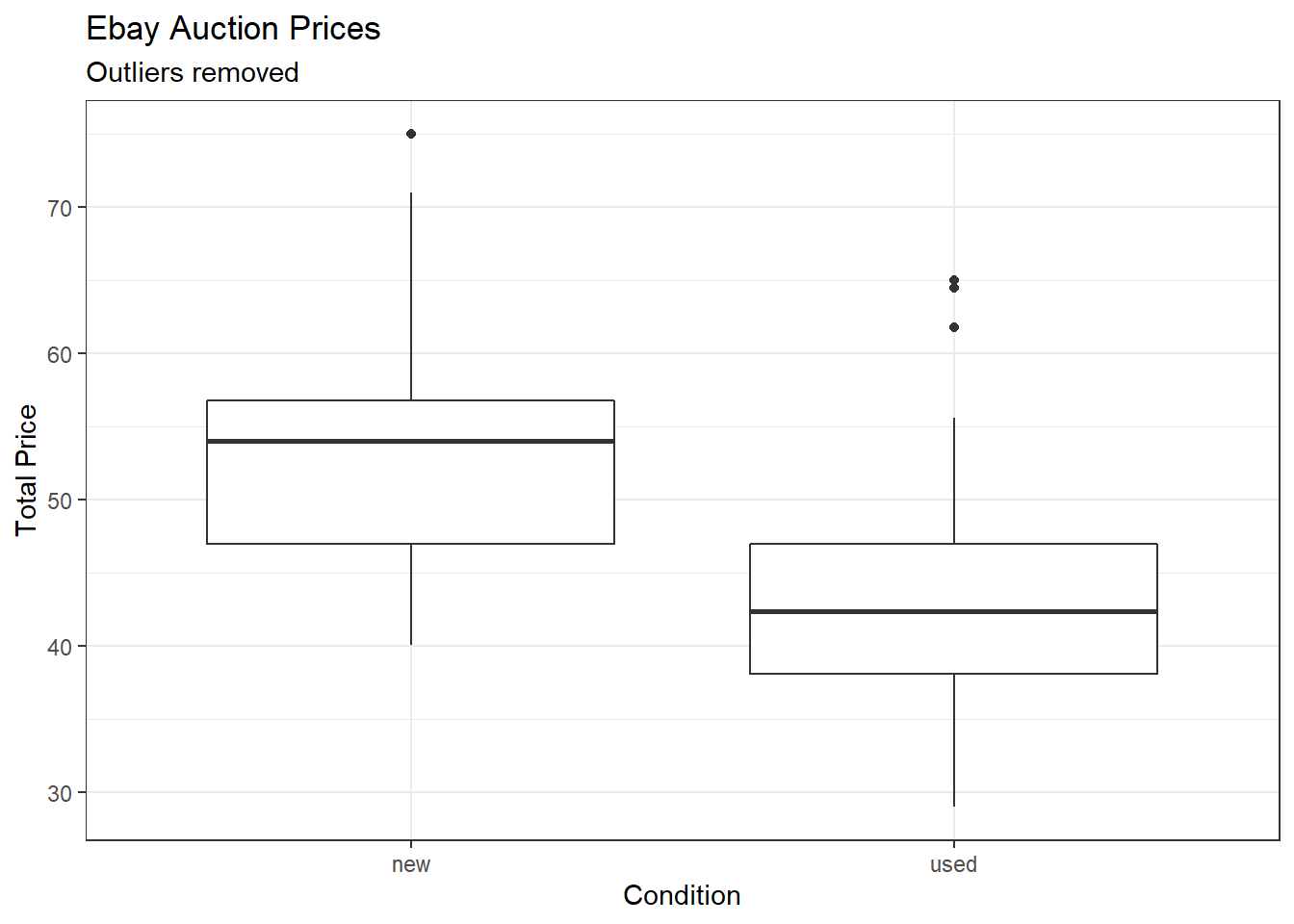

## # ... with 3 more variables: stock_photo <fct>, wheels <dbl>, title <chr>If you look at the variable title there were additional items in the sale for these two observations. Let’s remove those two outliers and run the model again. Note that the reason we are removing them is not because they are annoying us and messing up our model. It is because we don’t think they are representative of the population of interest. Figure 30.3 is a scatterplot of the data with the outliers dropped.

mariokart_new <- mariokart %>%

filter(total_pr <= 100) %>%

select(total_pr,cond,stock_photo,duration,wheels)summary(mariokart_new)## total_pr cond stock_photo duration wheels

## Min. :28.98 new :59 no : 36 Min. : 1.000 Min. :0.000

## 1st Qu.:41.00 used:82 yes:105 1st Qu.: 1.000 1st Qu.:0.000

## Median :46.03 Median : 3.000 Median :1.000

## Mean :47.43 Mean : 3.752 Mean :1.149

## 3rd Qu.:53.99 3rd Qu.: 7.000 3rd Qu.:2.000

## Max. :75.00 Max. :10.000 Max. :4.000mariokart_new %>%

gf_boxplot(total_pr~cond) %>%

gf_theme(theme_bw()) %>%

gf_labs(title="Ebay Auction Prices",subtitle="Outliers removed",x="Condition", y="Total Price")

Figure 30.3: Scatterplot of total price and condition with outliers removed.

mario_mod2 <- lm(total_pr~cond,data=mariokart_new)summary(mario_mod2)##

## Call:

## lm(formula = total_pr ~ cond, data = mariokart_new)

##

## Residuals:

## Min 1Q Median 3Q Max

## -13.8911 -5.8311 0.1289 4.1289 22.1489

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 53.7707 0.9596 56.034 < 2e-16 ***

## condused -10.8996 1.2583 -8.662 1.06e-14 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 7.371 on 139 degrees of freedom

## Multiple R-squared: 0.3506, Adjusted R-squared: 0.3459

## F-statistic: 75.03 on 1 and 139 DF, p-value: 1.056e-14Notice how much the residual standard error has decreased and likewise the \(R\)-squared has increased.

The model may be written as:

\[ \hat{total price} = 53.771 - 10.90 \times condused \]

Now we see that the average price for a used items is $10.90 less.

Exercise:

Does the linear model seem reasonable? Which assumptions should you check?

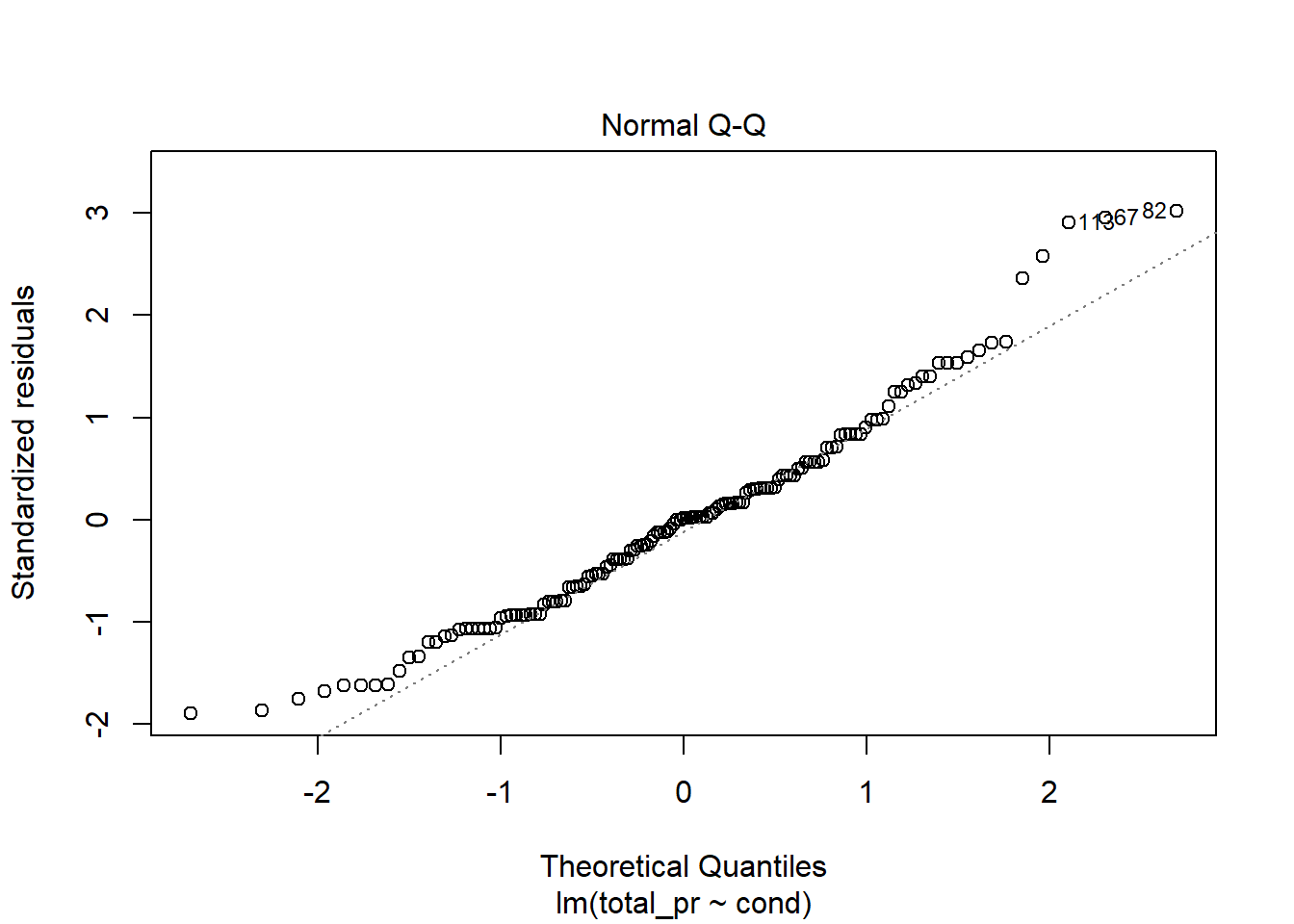

The model does seem reasonable although prices for new items appears to be skewed to the left and may not meet the normality assumptions, Figure 30.4.

plot(mario_mod2,2)

Figure 30.4: Check of normality using quantile-quantile plot.

The normality assumption is somewhat suspect but we have more than 100 data points so the short tails of the distribution are not a concern. The shape of this curve indicates a positive skew.

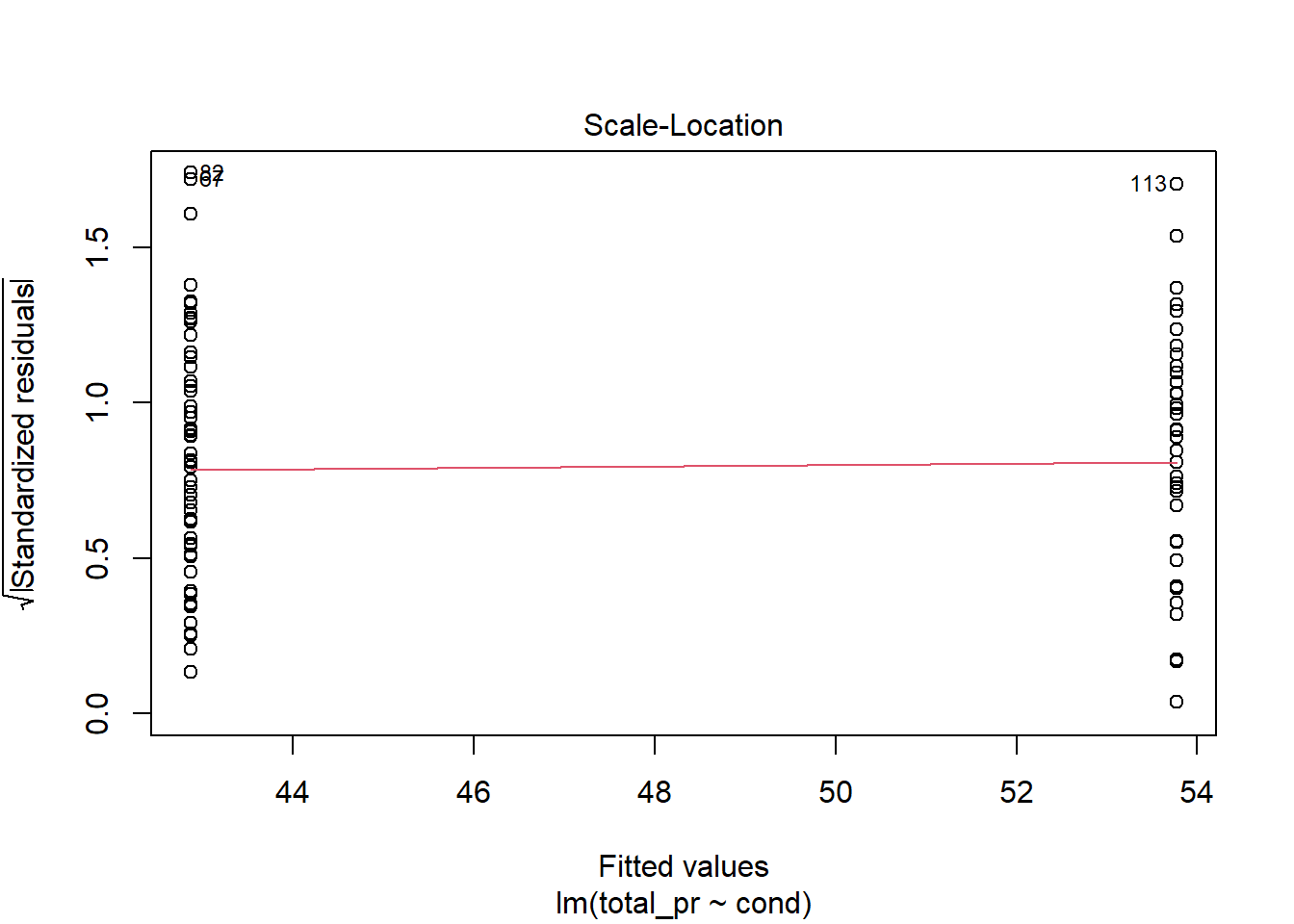

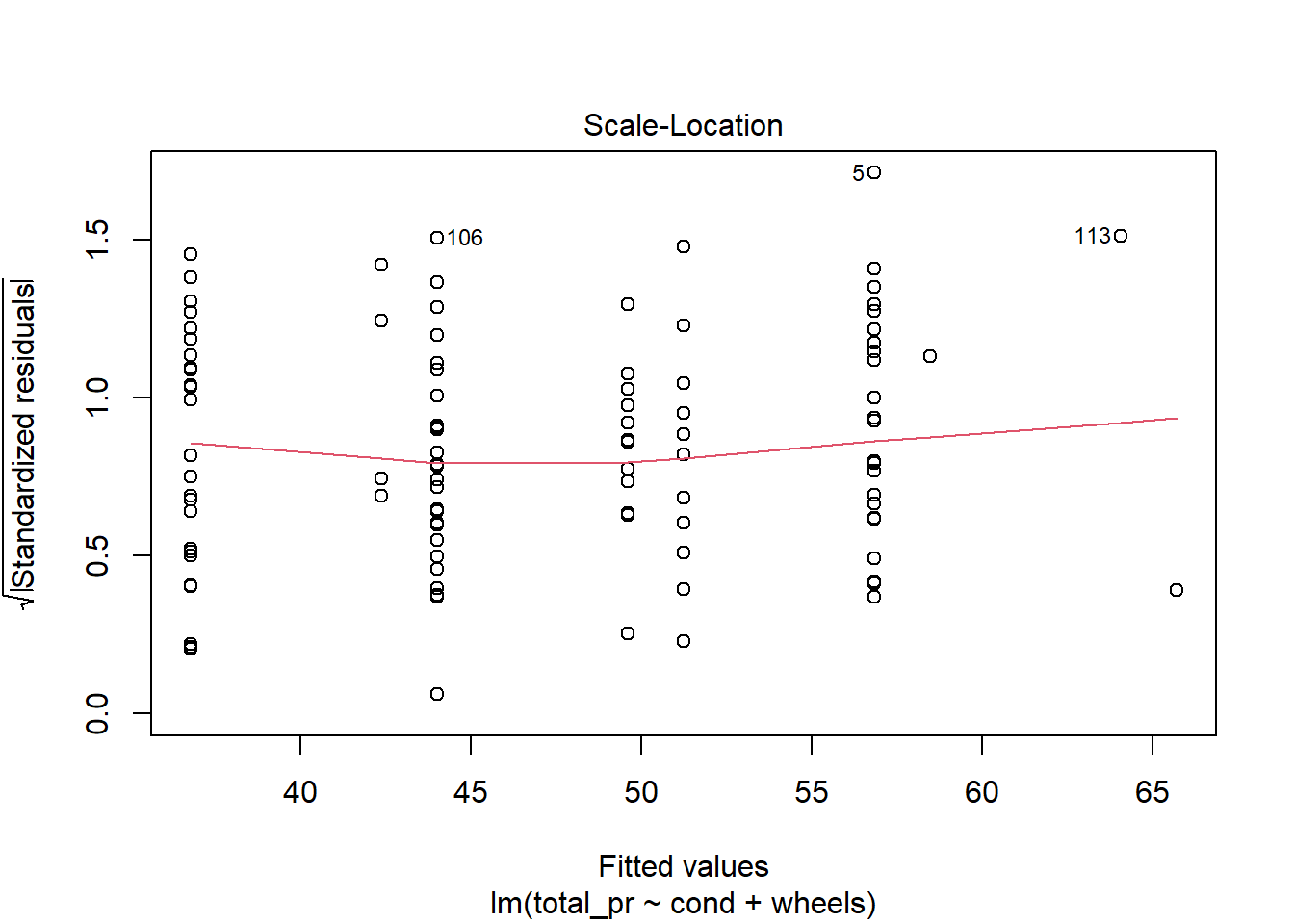

plot(mario_mod2,3)

Figure 30.5: Residual plot to assess equal variance assumption.

From Figure 30.5, equal variance seems reasonable.

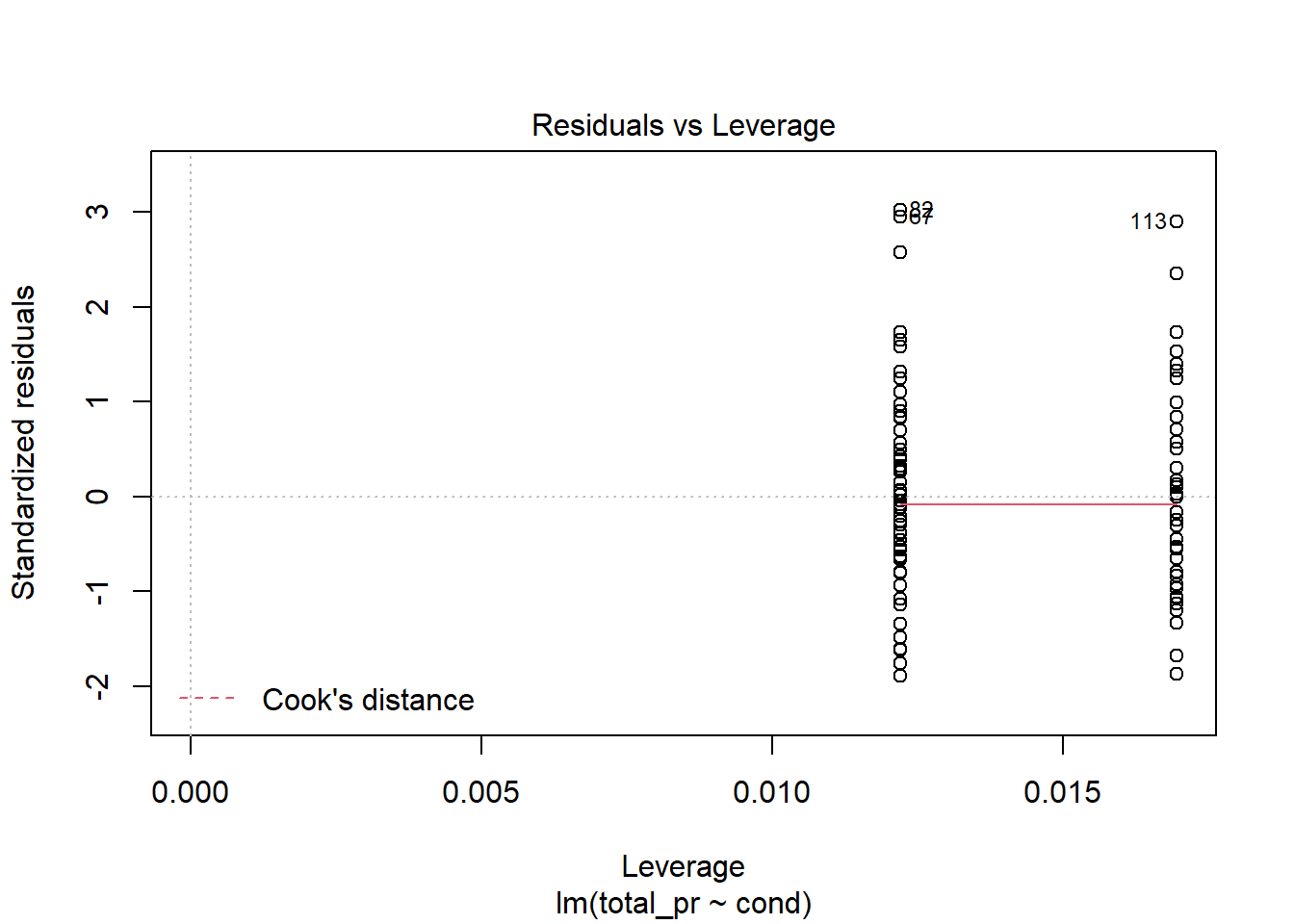

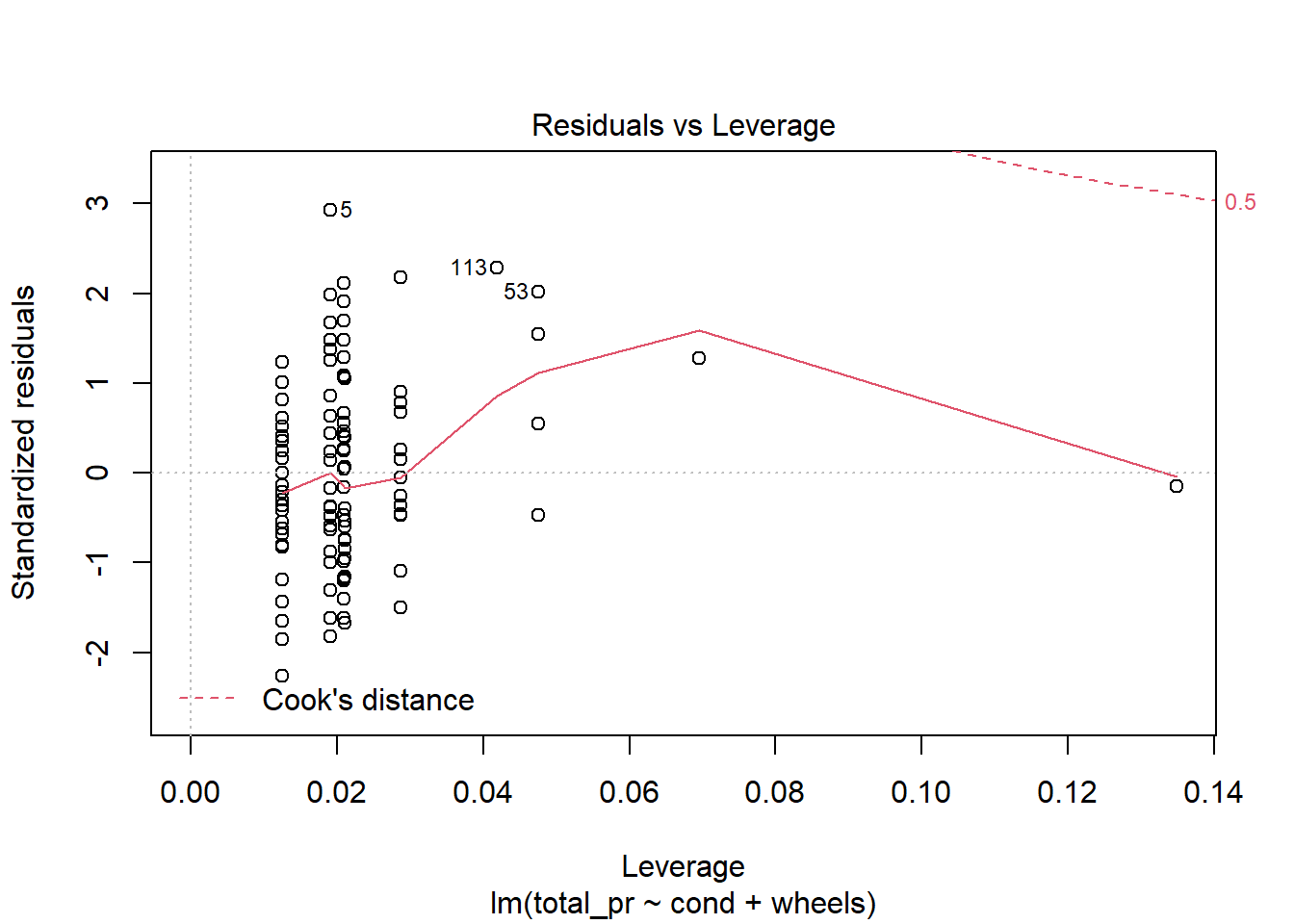

plot(mario_mod2,5)

Figure 30.6: Residual plot for checking leverage points.

No high leverage points, Figure 30.6.

No need to check linearity, we only have two different values for the explanatory variable.

Example: Interpretation

Interpret the coefficient for the game’s condition in the model. Is this coefficient significantly different from 0?

Note that cond is a two-level categorical variable and the reference level is new. So - 10.90 means that the model predicts an extra $10.90 on average for those games that are new versus those that are used. Examining the regression output, we can see that the p-value for cond is very close to zero, indicating there is strong evidence that the coefficient is different from zero when using this simple one-variable model.

30.3.2 Including and assessing many variables in a model

Sometimes there are underlying structures or relationships between predictor variables. For instance, new games sold on Ebay tend to come with more Wii wheels, which may have led to higher prices for those auctions. We would like to fit a model that includes all potentially important variables simultaneously. This would help us evaluate the relationship between a predictor variable and the outcome while controlling for the potential influence of other variables. This is the strategy used in multiple regression. While we remain cautious about making any causal interpretations using multiple regression, such models are a common first step in providing evidence of a causal connection.

We want to construct a model that accounts for not only the game condition, but simultaneously accounts for three other variables: stock_photo, duration, and wheels. This model can be represented as:

\[ \widehat{\text{totalprice}} = \beta_0 + \beta_1 \times \text{cond} + \beta_2 \times \text{stockphoto} + \beta_3 \times \text{duration} + \beta_4 \times \text{wheels} \]

or:

\[\begin{equation} \hat{y} = \beta_0 + \beta_1 x_1 + \beta_2 x_2 + \beta_3 x_3 + \beta_4 x_4 \tag{30.1} \end{equation}\]

In Equation (30.1), \(y\) represents the total price, \(x_1\) indicates whether the game is new, \(x_2\) indicates whether a stock photo was used, \(x_3\) is the duration of the auction, and \(x_4\) is the number of Wii wheels included with the game. Just as with the single predictor case, a multiple regression model may be missing important components or it might not precisely represent the relationship between the outcome and the available explanatory variables. While no model is perfect, we wish to explore the possibility that this model may fit the data reasonably well.

We estimate the parameters \(\beta_0\), \(\beta_1\), …, \(\beta_4\) in the same way as we did in the case of a single predictor. We select \(b_0\), \(b_1\), …, \(b_4\) that minimize the sum of the squared residuals:

\[ \text{SSE} = e_1^2 + e_2^2 + \dots + e_{141}^2 = \sum_{i=1}^{141} e_i^2 = \sum_{i=1}^{141} \left(y_i - \hat{y}_i\right)^2 \]

In our problem, there are 141 residuals, one for each observation. We use a computer to minimize the sum and compute point estimates.

mario_mod_multi <- lm(total_pr~., data=mariokart_new)The formula total_pr~. uses a dot. This means we want to use all the predictors. We could have also used the following code:

mario_mod_multi <- lm(total_pr~cond+stock_photo+duration+wheels, data=mariokart_new)Recall, the + symbol does not mean to literally add the predictors together. It is not a mathematical operation but a formula operation that means to include the predictor.

You can view a summary of the model using the summmary() function.

summary(mario_mod_multi)##

## Call:

## lm(formula = total_pr ~ ., data = mariokart_new)

##

## Residuals:

## Min 1Q Median 3Q Max

## -11.3788 -2.9854 -0.9654 2.6915 14.0346

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 41.34153 1.71167 24.153 < 2e-16 ***

## condused -5.13056 1.05112 -4.881 2.91e-06 ***

## stock_photoyes 1.08031 1.05682 1.022 0.308

## duration -0.02681 0.19041 -0.141 0.888

## wheels 7.28518 0.55469 13.134 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.901 on 136 degrees of freedom

## Multiple R-squared: 0.719, Adjusted R-squared: 0.7108

## F-statistic: 87.01 on 4 and 136 DF, p-value: < 2.2e-16| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 41.3415318 | 1.7116684 | 24.1527693 | 0.0000000 |

| condused | -5.1305641 | 1.0511238 | -4.8810276 | 0.0000029 |

| stock_photoyes | 1.0803108 | 1.0568238 | 1.0222241 | 0.3084897 |

| duration | -0.0268075 | 0.1904122 | -0.1407868 | 0.8882467 |

| wheels | 7.2851779 | 0.5546928 | 13.1337172 | 0.0000000 |

Using this output, Table 30.1, we identify the point estimates \(b_i\) of each \(\beta_i\), just as we did in the one-predictor case.

Multiple regression model

A multiple regression model is a linear model with many predictors.

In general, we write the model as

\[ \hat{y} = \beta_0 + \beta_1 x_1 + \beta_2 x_2 + \cdots + \beta_k x_k %+ \epsilon \]

when there are \(k\) predictors. We often estimate the \(\beta_i\) parameters using a computer.

Exercise: Write out the the multiple regression model using the point estimates from regression output. How many predictors are there in this model?96

Exercise:

What does \(\beta_4\), the coefficient of variable \(x_4\) (Wii wheels), represent? What is the point estimate of \(\beta_4\)?97

Exercise:

Compute the residual of the first observation in the dataframe using the regression equation.

mario_mod_multi$residuals[1]## 1

## 1.923402The broom package has a function augment that will calculate the predicted and residuals.

library(broom)augment(mario_mod_multi) %>%

head(1)## # A tibble: 1 x 11

## total_pr cond stock_photo duration wheels .fitted .resid .hat .sigma

## <dbl> <fct> <fct> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 51.6 new yes 3 1 49.6 1.92 0.0215 4.92

## # ... with 2 more variables: .cooksd <dbl>, .std.resid <dbl>\(e_i = y_i - \hat{y_i} = 51.55 - 49.62 = 1.93\)

Example:

We estimated a coefficient forcondas \(b_1 = - 10.90\) with a standard error of \(SE_{b_1} = 1.26\) when using simple linear regression. Why might there be a difference between that estimate and the one in the multiple regression setting?

If we examined the data carefully, we would see that some predictors are correlated. For instance, when we estimated the connection of the outcome total_pr and predictor cond using simple linear regression, we were unable to control for other variables like the number of Wii wheels included in the auction. That model was biased by the confounding variable wheels. When we use both variables, this particular underlying and unintentional bias is reduced or eliminated (though bias from other confounding variables may still remain).

The previous example describes a common issue in multiple regression: correlation among predictor variables. We say the two predictor variables are collinear (pronounced as co-linear) when they are correlated, and this collinearity complicates model estimation. While it is impossible to prevent collinearity from arising in observational data, experiments are usually designed to prevent predictors from being collinear.

Exercise:

The estimated value of the intercept is 41.34, and one might be tempted to make some interpretation of this coefficient, such as, it is the model’s predicted price when each of the variables take a value of zero: the game is new, the primary image is not a stock photo, the auction duration is zero days, and there are no wheels included. Is there any value gained by making this interpretation?98

30.3.3 Inference

From the printout of the model summary, we can see that both the stock_photo and duration variables are not significantly different from zero. Thus we may want to drop them from the model. In Math 378, we will explore ways to determine the best model including the use of p-values.

Likewise, we could generate confidence intervals for the coefficients:

confint(mario_mod_multi)## 2.5 % 97.5 %

## (Intercept) 37.9566036 44.7264601

## condused -7.2092253 -3.0519030

## stock_photoyes -1.0096225 3.1702442

## duration -0.4033592 0.3497442

## wheels 6.1882392 8.3821165This confirms that the stock_photo and duration may not have an impact on total price.

30.3.4 Adjusted \(R^2\) as a better estimate of explained variance

We first used \(R^2\) in simple linear regression to determine the amount of variability in the response that was explained by the model: \[ R^2 = 1 - \frac{\text{variability in residuals}}{\text{variability in the outcome}} = 1 - \frac{Var(e_i)}{Var(y_i)} \] where \(e_i\) represents the residuals of the model and \(y_i\) the outcomes. This equation remains valid in the multiple regression framework, but a small enhancement can often be even more informative.

Exercise: The variance of the residuals for the model is 23.34, and the variance of the total price in all the auctions is 83.06. Calculate \(R^2\) for this model.99

augment(mario_mod_multi) %>%

summarise(var_resid=var(.resid))## # A tibble: 1 x 1

## var_resid

## <dbl>

## 1 23.3mariokart_new %>%

summarise(total_var=var(total_pr))## # A tibble: 1 x 1

## total_var

## <dbl>

## 1 83.11-23.34/83.05864## [1] 0.7189937summary(mario_mod_multi)$r.squared## [1] 0.7190261This strategy for estimating \(R^2\) is acceptable when there is just a single variable. However, it becomes less helpful when there are many variables. The regular \(R^2\) is actually a biased estimate of the amount of variability explained by the model. To get a better estimate, we use the adjusted \(R^2\).

Adjusted \(\mathbf{R^2}\) as a tool for model assessment:

The adjusted \(\mathbf{R^2}\) is computed as: \[ R_{adj}^{2} = 1-\frac{Var(e_i) / (n-k-1)}{Var(y_i) / (n-1)} = 1-\frac{Var(e_i)}{Var(y_i)} \times \frac{n-1}{n-k-1} \] where \(n\) is the number of cases used to fit the model and \(k\) is the number of predictor variables in the model.

Because \(k\) is never negative, the adjusted \(R^2\) will be smaller – often times just a little smaller – than the unadjusted \(R^2\). The reasoning behind the adjusted \(R^2\) lies in the degrees of freedom associated with each variance.100

Exercise:

There were \(n=141\) auctions in themariokartdata set and \(k=4\) predictor variables in the model. Use \(n\), \(k\), and the appropriate variances to calculate \(R_{adj}^2\) for the Mario Kart model.101

summary(mario_mod_multi)$adj.r.squared## [1] 0.7107622Exercise:

Suppose you added another predictor to the model, but the variance of the errors \(Var(e_i)\) didn’t go down. What would happen to the \(R^2\)? What would happen to the adjusted \(R^2\)?102

Again, in Math 378 we will spend more time on how to select models. Using internal metrics of performance such as p-values or adjusted \(R\) squared are one way but using external measures of predictive performance such as cross validation or hold out sets will be introduced.

30.3.5 Reduced model

Now let’s drop duration from the model and compare to our previous model:

mario_mod_multi2 <- lm(total_pr~cond+stock_photo+wheels, data=mariokart_new)And the summary:

summary(mario_mod_multi2)##

## Call:

## lm(formula = total_pr ~ cond + stock_photo + wheels, data = mariokart_new)

##

## Residuals:

## Min 1Q Median 3Q Max

## -11.454 -2.959 -0.949 2.712 14.061

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 41.2245 1.4911 27.648 < 2e-16 ***

## condused -5.1763 0.9961 -5.196 7.21e-07 ***

## stock_photoyes 1.1177 1.0192 1.097 0.275

## wheels 7.2984 0.5448 13.397 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.884 on 137 degrees of freedom

## Multiple R-squared: 0.719, Adjusted R-squared: 0.7128

## F-statistic: 116.8 on 3 and 137 DF, p-value: < 2.2e-16As a reminder, the previous model summary is:

summary(mario_mod_multi)##

## Call:

## lm(formula = total_pr ~ ., data = mariokart_new)

##

## Residuals:

## Min 1Q Median 3Q Max

## -11.3788 -2.9854 -0.9654 2.6915 14.0346

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 41.34153 1.71167 24.153 < 2e-16 ***

## condused -5.13056 1.05112 -4.881 2.91e-06 ***

## stock_photoyes 1.08031 1.05682 1.022 0.308

## duration -0.02681 0.19041 -0.141 0.888

## wheels 7.28518 0.55469 13.134 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.901 on 136 degrees of freedom

## Multiple R-squared: 0.719, Adjusted R-squared: 0.7108

## F-statistic: 87.01 on 4 and 136 DF, p-value: < 2.2e-16Notice that the adjusted \(R^2\) improved by dropping duration. Finally, let’s drop stock_photo.

mario_mod_multi3 <- lm(total_pr~cond+wheels, data=mariokart_new)summary(mario_mod_multi3)##

## Call:

## lm(formula = total_pr ~ cond + wheels, data = mariokart_new)

##

## Residuals:

## Min 1Q Median 3Q Max

## -11.0078 -3.0754 -0.8254 2.9822 14.1646

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 42.3698 1.0651 39.780 < 2e-16 ***

## condused -5.5848 0.9245 -6.041 1.35e-08 ***

## wheels 7.2328 0.5419 13.347 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.887 on 138 degrees of freedom

## Multiple R-squared: 0.7165, Adjusted R-squared: 0.7124

## F-statistic: 174.4 on 2 and 138 DF, p-value: < 2.2e-16Though the adjusted \(R^2\)dropped a little, it is only in the fourth decimal place and thus essentially the same value. We therefor will go with this model. Again, Math 378 will go more into depth about model selection.

30.3.6 Confidence and prediction intervals

Let’s suppose we want to predict the average total price for a Mario Kart sale with 2 wheels and in new condition. We can again use the predict() function.

predict(mario_mod_multi3,newdata=data.frame(cond="new",wheels=2),interval = "confidence")## fit lwr upr

## 1 56.83544 55.49789 58.17299We are 95% confident that the average price of a Mario Kart sale for a new item with 2 wheels will be between 55.50 and 58.17.

Exercise: Find and interpret the prediction interval for a new Mario Kart with 2 wheels.

predict(mario_mod_multi3,newdata=data.frame(cond="new",wheels=2),interval = "prediction")## fit lwr upr

## 1 56.83544 47.07941 66.59147We are 95% confident that the price of a Mario Kart sale for a new item with 2 wheels will be between 47.07 and 66.59.

30.3.7 Diagnostics

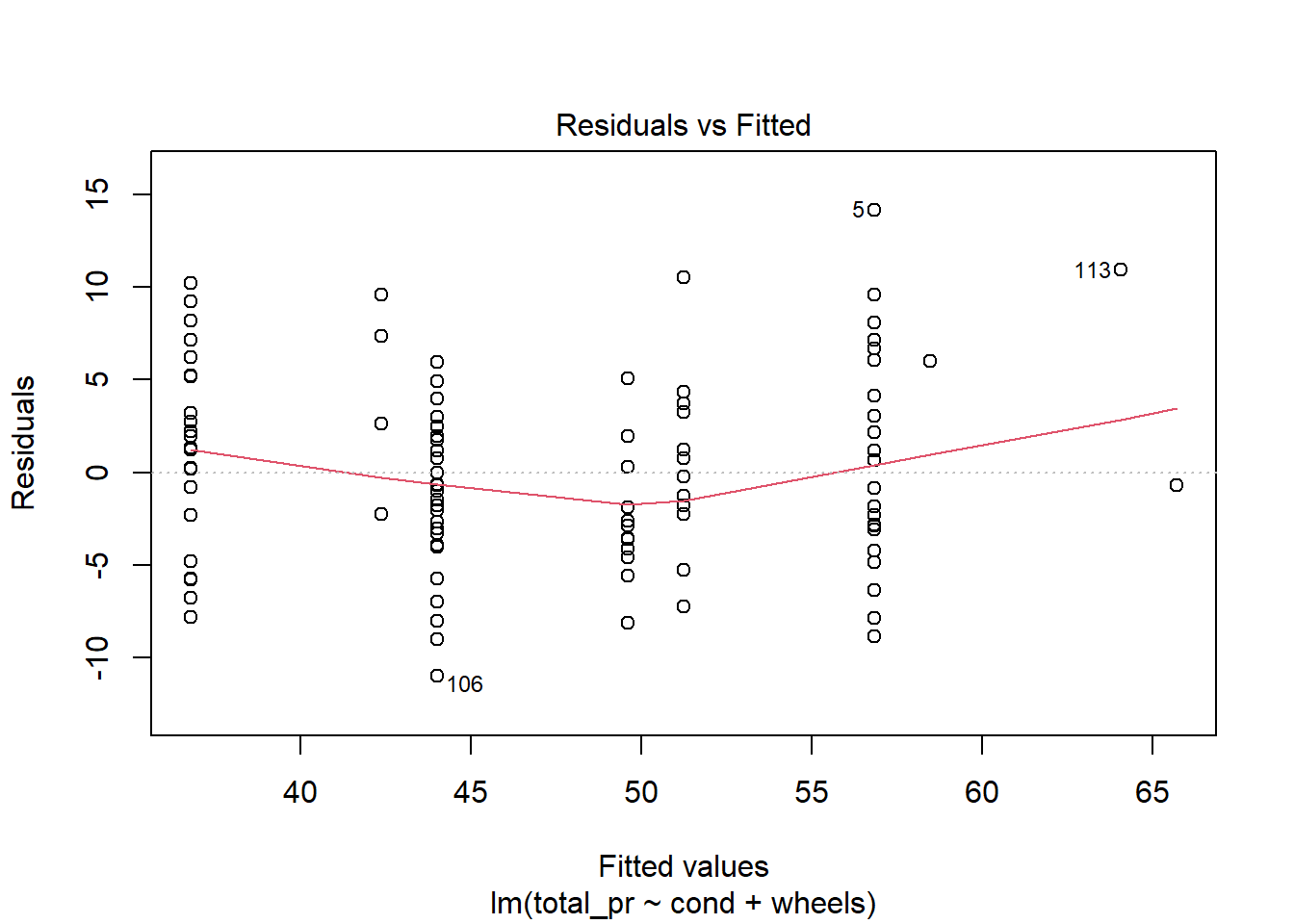

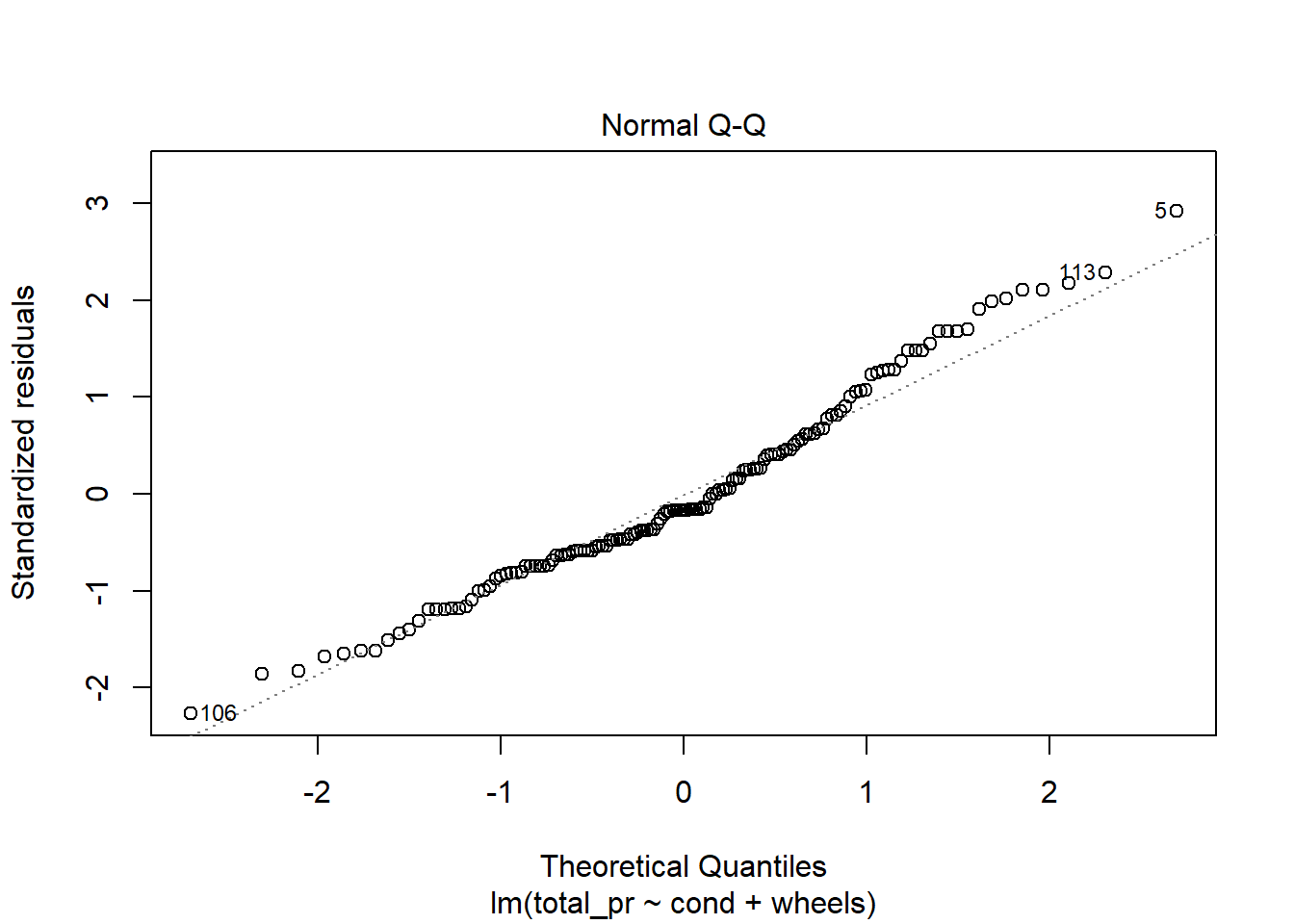

The diagnostics for the model are similar to what we did in a previous lesson. Nothing in these plots gives us concern, Figure 30.7.

plot(mario_mod_multi3)

Figure 30.7: Diagnostic residual plots for multiple regression model.

30.4 Interaction and Higher Order Terms

As a final short topic we want to explore feature engineering. Thus far we have not done any transformation to the predictors in the data set except maybe making categorical variables into factors. In data analysis competitions, such as Kaggle, feature engineering is often one of the most important steps. In Math 378, we will look at different tools but in this class we will look at simple transformations such as higher order terms and interactions.

To make this section more relevant, we are going to switch to a different data set. Load the library ISLR, this is a package that you will use a great deal in Math 378.

library(ISLR)The data set of interest is Credit. Use the help menu to read about the variables. This is a simulated data set of credit card debt.

glimpse(Credit)## Rows: 400

## Columns: 12

## $ ID <int> 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 1~

## $ Income <dbl> 14.891, 106.025, 104.593, 148.924, 55.882, 80.180, 20.996, 7~

## $ Limit <int> 3606, 6645, 7075, 9504, 4897, 8047, 3388, 7114, 3300, 6819, ~

## $ Rating <int> 283, 483, 514, 681, 357, 569, 259, 512, 266, 491, 589, 138, ~

## $ Cards <int> 2, 3, 4, 3, 2, 4, 2, 2, 5, 3, 4, 3, 1, 1, 2, 3, 3, 3, 1, 2, ~

## $ Age <int> 34, 82, 71, 36, 68, 77, 37, 87, 66, 41, 30, 64, 57, 49, 75, ~

## $ Education <int> 11, 15, 11, 11, 16, 10, 12, 9, 13, 19, 14, 16, 7, 9, 13, 15,~

## $ Gender <fct> Male, Female, Male, Female, Male, Male, Female, Male, F~

## $ Student <fct> No, Yes, No, No, No, No, No, No, No, Yes, No, No, No, No, No~

## $ Married <fct> Yes, Yes, No, No, Yes, No, No, No, No, Yes, Yes, No, Yes, Ye~

## $ Ethnicity <fct> Caucasian, Asian, Asian, Asian, Caucasian, Caucasian, Africa~

## $ Balance <int> 333, 903, 580, 964, 331, 1151, 203, 872, 279, 1350, 1407, 0,~Suppose we suspected that there is a relationship between Balance, the response, and the predictors Income and Student. Note: we actually are using this model for educational purposes and did not go through a model selection process.

The first model simply has these predictors in the model.

credit_mod1<-lm(Balance~Income+Student,data=Credit)summary(credit_mod1)##

## Call:

## lm(formula = Balance ~ Income + Student, data = Credit)

##

## Residuals:

## Min 1Q Median 3Q Max

## -762.37 -331.38 -45.04 323.60 818.28

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 211.1430 32.4572 6.505 2.34e-10 ***

## Income 5.9843 0.5566 10.751 < 2e-16 ***

## StudentYes 382.6705 65.3108 5.859 9.78e-09 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 391.8 on 397 degrees of freedom

## Multiple R-squared: 0.2775, Adjusted R-squared: 0.2738

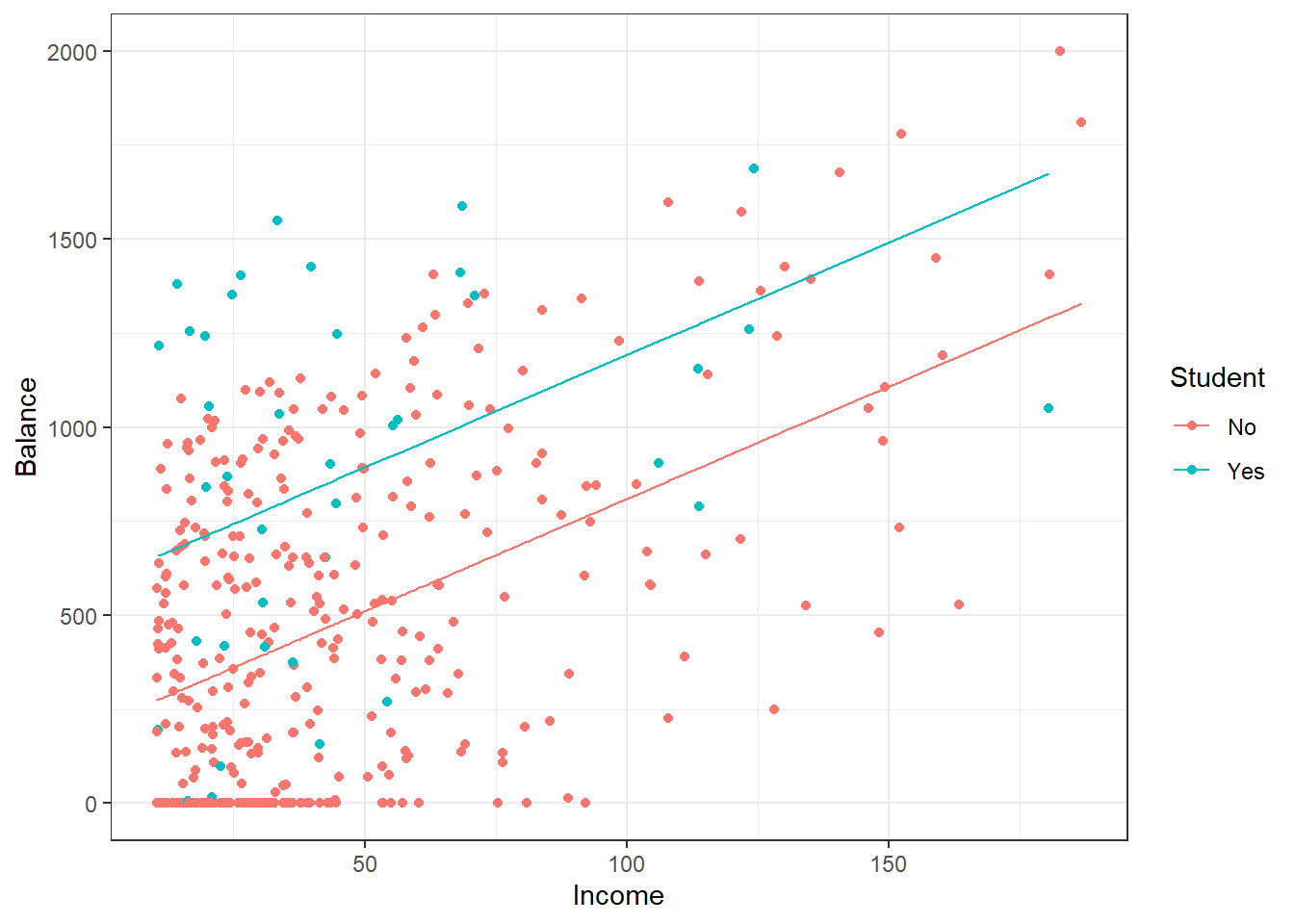

## F-statistic: 76.22 on 2 and 397 DF, p-value: < 2.2e-16Let’s plot the data and the regression line. The impact of putting in the categorical variable Student is to just shift the intercept. The slope remains the same, Figure 30.8.

augment(credit_mod1) %>%

gf_point(Balance~Income,color=~Student) %>%

gf_line(.fitted~Income,data=subset(augment(credit_mod1), Student == "Yes"),color=~Student)%>%

gf_line(.fitted~Income,data=subset(augment(credit_mod1), Student == "No"),color=~Student) %>%

gf_theme(theme_bw())

Figure 30.8: Scatterplot of credit card balance for income and student status.

Exercise:

Write the equation for the regression model.

\[ \mbox{E}(Balance)=\beta_0 + \beta_1*\text{Income}+ \beta_2*\text{(Student=Yes)} \]

or

\[ \mbox{E}(Balance)=211.14 + 5.98*\text{Income}+ 382.67*\text{(Student=Yes)} \]

If the observation is a student, then the intercept is increased by 382.67.

In this case, we would want to include an interaction term in the model: an interaction term allows the slope to change as well. To include an interaction term when building a model in R, we use *.

credit_mod2<-lm(Balance~Income*Student,data=Credit)summary(credit_mod2)##

## Call:

## lm(formula = Balance ~ Income * Student, data = Credit)

##

## Residuals:

## Min 1Q Median 3Q Max

## -773.39 -325.70 -41.13 321.65 814.04

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 200.6232 33.6984 5.953 5.79e-09 ***

## Income 6.2182 0.5921 10.502 < 2e-16 ***

## StudentYes 476.6758 104.3512 4.568 6.59e-06 ***

## Income:StudentYes -1.9992 1.7313 -1.155 0.249

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 391.6 on 396 degrees of freedom

## Multiple R-squared: 0.2799, Adjusted R-squared: 0.2744

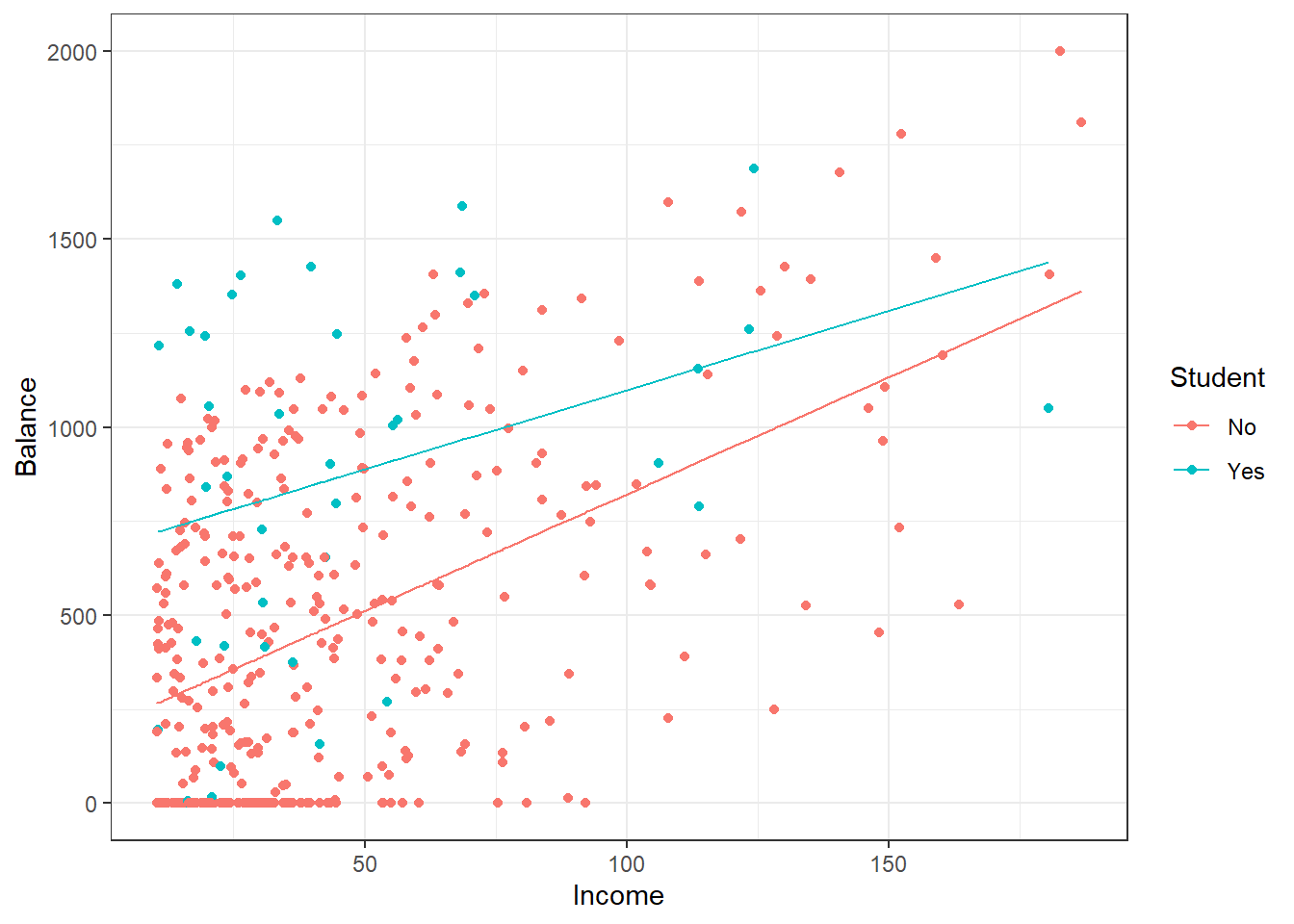

## F-statistic: 51.3 on 3 and 396 DF, p-value: < 2.2e-16augment(credit_mod2) %>%

gf_point(Balance~Income,color=~Student) %>%

gf_line(.fitted~Income,data=subset(augment(credit_mod2), Student == "Yes"),color=~Student)%>%

gf_line(.fitted~Income,data=subset(augment(credit_mod2), Student == "No"),color=~Student) %>%

gf_theme(theme_bw())

Figure 30.9: Scatterplot of credit card balance for income and student status with an interaction term.

Now we have a different slope and intercept for each case of the Student variable, Figure 30.9. Thus there is a synergy or interaction between these variables. The student status changes the impact of Income on Balance. If you are a student, then for every increase in income of 1 the balance increase by 4.219 on average. If you are not a student, every increase in income of 1 increases the average balance by 6.2182.

Furthermore, if you suspect that perhaps a curved relationship exists between two variables, we could include a higher order term. As an example, let’s add a quadratic term for Income to our model (without the interaction). To do this in R, we need to wrap the higher order term in I(). If we include a higher order term, we usually want to include the lower order terms as well, in Math 378 you will make the decision on what to include using predictive performance.

credit_mod3<-lm(Balance~Income+I(Income^2),data=Credit)summary(credit_mod3)##

## Call:

## lm(formula = Balance ~ Income + I(Income^2), data = Credit)

##

## Residuals:

## Min 1Q Median 3Q Max

## -782.88 -361.40 -54.98 316.26 1104.39

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 285.3973 54.1720 5.268 2.26e-07 ***

## Income 4.3972 1.9078 2.305 0.0217 *

## I(Income^2) 0.0109 0.0120 0.908 0.3642

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 408 on 397 degrees of freedom

## Multiple R-squared: 0.2166, Adjusted R-squared: 0.2127

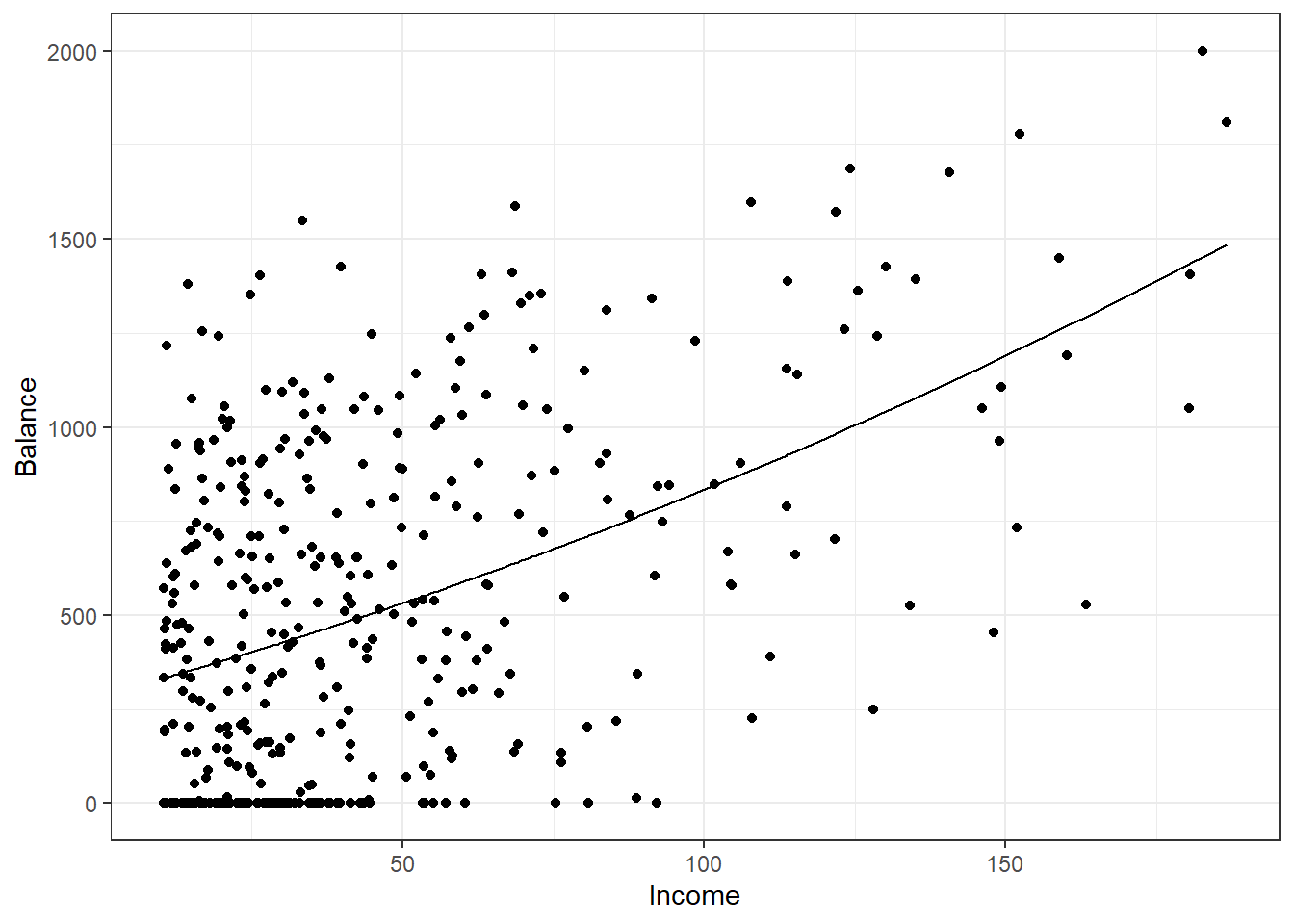

## F-statistic: 54.88 on 2 and 397 DF, p-value: < 2.2e-16augment(credit_mod3) %>%

gf_point(Balance~Income) %>%

gf_line(.fitted~Income) %>%

gf_theme(theme_bw())

Figure 30.10: Scatterplot of credit card balance for income with a quadratic fit.

There is not much of a quadratic relationship, Figure 30.10.

30.4.1 Summary

In this lesson we have extended the linear regression model by allowing multiple predictors. This allows us to account for confounding variables and make more sophisticated models. The interpretation and evaluation of the model changes.

30.5 Homework Problems

. The mtcars data set contains average mileage (mpg) and other information about specific makes and models of cars. (This data set is built-in to R; for more information about this data set, reference the documentation with ?mtcars).

- Build and interpret the coefficients of a model fitting

mpgagainst displacement (disp), horsepower (hp), rear axle ratio (drat), and weight in 1000 lbs (wt).

- Given your model, what is the expected mpg for a vehicle with a displacement of 170, a horsepower of 100, a

dratof 3.80 and a wt of 2,900 lbs. Construct a 95% confidence interval and prediction interval for that expected mpg.

- Repeat part (b) with a bootstrap for the confidence interval.

. Is that the best model for predicting mpg? Try a variety of different models. You could explore higher order terms or even interactions. One place to start is by using the pairs() function on mtcars to plot a large pairwise scatterplot. How high could you get adjusted \(R\)-squared? Keep in mind that is only one measure of fit.

Diez DM, Barr CD, and etinkaya-Rundel M. 2012.

openintro: OpenIntro data sets and supplemental functions. http://cran.r-project.org/web/packages/openintro↩︎\(\hat{y} = 41.34 + - 5.13x_1 + 1.08x_2 - 0.03x_3 + 7.29x_4\), and there are \(k=4\) predictor variables.↩︎

It is the average difference in auction price for each additional Wii wheel included when holding the other variables constant. The point estimate is \(b_4 = 7.29\).↩︎

Three of the variables (

cond,stock_photo, andwheels) do take value 0, but the auction duration is always one or more days. If the auction is not up for any days, then no one can bid on it! That means the total auction price would always be zero for such an auction; the interpretation of the intercept in this setting is not insightful.↩︎\(R^2 = 1 - \frac{23.34}{83.06} = 0.719\).↩︎

In multiple regression, the degrees of freedom associated with the variance of the estimate of the residuals is \(n-k-1\), not \(n-1\). For instance, if we were to make predictions for new data using our current model, we would find that the unadjusted \(R^2\) is an overly optimistic estimate of the reduction in variance in the response, and using the degrees of freedom in the adjusted \(R^2\) formula helps correct this bias.↩︎

\(R_{adj}^2 = 1 - \frac{23.34}{83.06}\times \frac{141-1}{141-4-1} = 0.711\).↩︎

The unadjusted \(R^2\) would stay the same and the adjusted \(R^2\) would go down. Note that unadjusted \(R^2\) never decreases by adding another predictor, it can only stay the same or increase. The adjusted \(R^2\) increases only if the addition of a predictor reduces the variance of the error larger than add one to \(k\) in denominator.↩︎